Quietly Ticking Time Bomb in Fed Data

Last week, the Federal Reserve was finally forced by law to release some (not all) of the details of its back-door bailout of the global financial system. The Fed data focuses on the emergency lending programs initiated in 2007/2008, but it also includes data for the Fed's more recent purchases of mortgage-backed securities (MBS). These later purchases represent the real risk for taxpayers in the Fed's continuing bailout activities, but have received the least coverage in the mainstream press.

Federal Reserve Efforts Dwarf TARP

The Fed data supports our long-held contention that the Congressionally-approved and much despised $700 billion Troubled Asset Relief Program (TARP) was only a small fraction of the total bailout. By our count, and as we illustrate below, TARP funds were a mere seven percent of total funds disbursed by federal government to aid the financial sector since 2007. Why does this matter? Because the more we focus on the much-despised TARP, the less we see the invisible hand of the Fed doing the heavy lifting.

Mortgage-Backed Insecurities?

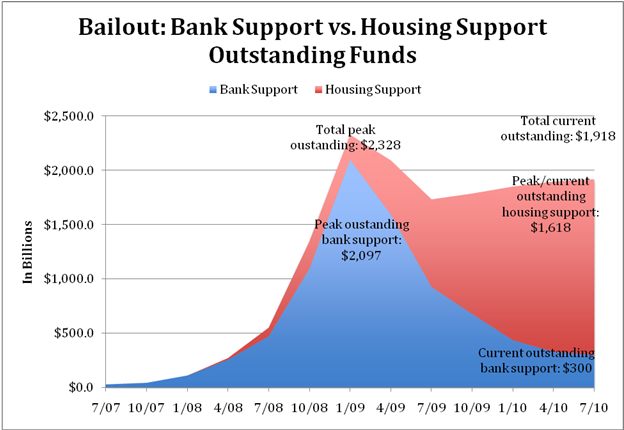

As our next graph shows, the second phase of the bailout is all about housing. The Fed and the U.S. Treasury Department have struggled mightily to keep the housing and mortgage markets from melting down by pumping $300 billion in direct loans into Fannie Mae (the Federal National Mortgage Association) and Freddie Mac (the Federal Home Loan Mortgage Corporation) and collectively buying up $1.6 trillion in mortgage-backed securities (MBS) guaranteed by Fannie and Freddie. While Fed emergency loan programs have largely been wound down, these MBS purchases are still on the books.

These MBS purchases represent the most significant intervention in the housing sector in history, yet have not been subject to the scrutiny or oversight to which the TARP has been subject. Why is this a problem? Recent developments suggest these funds could be at risk.

If you read the headlines, you know that banks stand accused of robo-signing mortgages, shredding original mortgages, failing to notarize properly and otherwise breaking or bending the law to feed the Wall Street securitization machine. These problems are only coming to light now because the same banks are rushing to throw Americans out of their homes. As some homeowners fight back in court, more illegal practices are uncovered.

In addition to outright fraud, numerous state Supreme Courts have questioned the legality of the Mortgage Electronic Registration or "MERS" system. MERS is the mortgage holder of record for 60 percent of U.S. mortgages, yet its legal standing to foreclose on American homeowners is in doubt and its shoddy processing of the promissory notes for millions of mortgages has ramifications for the securitization process as well.

In short, by screwing up the mortgage registration and transfer system, the big banks may have also screwed up the securitization process under New York trust law, casting doubt on the legality of an untold number of foreclosures and potentially trillions of dollars worth of MBS -- some of them held by U.S. taxpayers via the Fed, Treasury, Fannie Mae and Freddie Mac.

Hot Potato Actions Proliferate

This may explain why many private investors, and the Fed itself, are trying to force the big banks to buy back the troubled securities. Recently, the New York Fed requested that Bank of America take back $47 billion of mortgage securities, alleging that the bank didn't properly "service" the mortgages. Fannie and Freddie are starting to push the banks to take back $13 billion of MBS and these are early days. "Put-back" lawsuits are in the works from investors across the nation and this entire house of cards may come tumbling down.

Not surprisingly, the big banks are balking at taking back flawed securities. Acting like they are above the law, Bank of America and J.P. Morgan Chase, are refusing to buy back flawed securities from Fannie and Freddie. At the same time, they are refusing to modify mortgages for the very taxpayers who bailed them out during the crisis to the tune of $931 billion for Bank of America and $161 billion for J.P. Morgan Fed documents reveal. Only very recently have some regulators cautiously conceded that the mortgage mess poses "systemic risk" to the economy. But the only government report on the risks these securities pose was issued by the feisty Congressional Oversight Panel for the TARP. The report warns "it is possible that 'robo-signing' may have concealed deeper problems in the mortgage market that could potentially threaten financial stability."

Time to "Stress Test" the Fed?

The big banks themselves may have trillions of dollars worth of questionable securities on their books. Now we learn that the federal government does as well. While Fed Chair Ben Bernanke will be "stress testing" the banks for their exposure to faulty MBS, he has indicated that he won't make this information public. What does Bernanke have to hide? The sky did not fall when this information was released in the past, nor did it when the Fed data was released last week. It's time to stress test the Fed. Should the MBS issue blow up in the courts, U.S. taxpayers could be on the hook for billions, dwarfing the cost of the bailout thus-far. In the build-up to the 2008 meltdown, the Fed looked the other way as the big banks sold predatory and abusive mortgages to millions of American families. The result? A historic financial crisis and untold misery. Now the Fed is AWOL as the same banks abusively foreclose on millions using faulty documentation and illegal practices. Once again, the devil is in the details, and these details may hold the key to the next crisis. Congress needs to step up and put Bernanke on the stand to tell us exactly what he plans to do if trillions of dollars worth of mortgage-backed securities detonate. Jamie Dimon of J.P. Morgan Chase assures us that we will undergo financial crises every five to seven years. With Dimon and Bernanke's help, we may be ahead of schedule.

Comments

Federal and state government

Federal and state government reserves are straining and almost breaking several state budgets. The federal government is also showing the strain. For 60 percent of states, unemployment trust fund reserves have simply run out. Maryland, however, is saving itself millions of dollars. They've done this by paying back their federal unemployment loan.

The fed

Isn't it time we declared the national debt and the F.E.D. null and void? These masterminds of financial disaster must get what they deserve, a long time behind bars. We could purge our government of the financial industries insiders and undertake the control of currency for the benefit of all instead of the few. It would be a monumental task but probably less painful than the bailout of a bunch of crooks.

With the government's

With the government's purchase of MBS, are you referring to Maiden Lanes, I, II and III?