Will the Department of Education Crack Down on For-Profit Colleges?

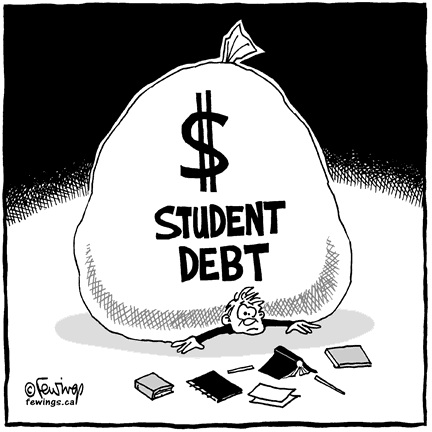

On every TV channel, commercials for schools like DeVry and the University of Phoenix blare promises of better-paying jobs. Every year over a million Americans respond to these sales pitches. All too often these students receive tens of thousands of dollars in debt and very little else. The Department of Education was expected last week to release new "gainful employment" regulations that would limit the ability of such for-profit colleges to charge exorbitant prices for illusory job gains. Now it seems that the Obama administration is wavering in the face of aggressive industry lobbying. For-profit education is big business in America, and big business means political clout.

On every TV channel, commercials for schools like DeVry and the University of Phoenix blare promises of better-paying jobs. Every year over a million Americans respond to these sales pitches. All too often these students receive tens of thousands of dollars in debt and very little else. The Department of Education was expected last week to release new "gainful employment" regulations that would limit the ability of such for-profit colleges to charge exorbitant prices for illusory job gains. Now it seems that the Obama administration is wavering in the face of aggressive industry lobbying. For-profit education is big business in America, and big business means political clout.

How For-Profit Colleges Work (Or Don't Work)

As the resources of public four-year and community colleges have been pushed to their limits by state budget cuts and rising demand, for-profit career colleges have taken up much of the slack. Yet the performance of some of these institutions is shady given their high costs. According to the College Entrance Examination Board, graduates of for-profit colleges leave school with an average of $29,500 in debt, almost three times as much as graduates of four-year public colleges. According to a recent New York Times article, for-profit college graduates account for 44% of student loan defaults, despite constituting only seven percent of the overall student population.

For-profit colleges earn money not on tuition paid directly by students, but through federal grants and federal student loan programs. Last year 86% of the revenue of the Apollo Group, the parent company of the University of Phoenix, came from federal sources. In February of this year, the Department of Education proposed surprisingly stringent regulations cracking down on schools that leave students with a lot of debt and only a little employability. Under the "gainful employment" regulations, colleges would be ineligible for federal student aid if the debt load of graduates could not be repaid with eight percent of the starting salary of graduates over the course of ten years. It has long been federal law that federal student aid was intended to "prepare student for gainful employment in a recognized occupation." These regulations would give this requirement some teeth.

The Industry Backlash

Naturally, the response of the Career College Association (CCA), a lobbying group and trade organization of over 1,500 for-profit colleges, has been aggressive. The CCA has even thrown together an astroturf organization of career college students, the "Students for Academic Choice." The industry's efforts seem to be paying off, and some analysts believe that the gainful employment regulations will be watered down or shelved.

The substance of the industry's claims is far from convincing. CCA president Harvey Miller contends that there is a reverse correlation between debt-income ratio and student loan default. Yes, apparently the CCA believes that persons with more debt and less income default less. Moreover, the CCA sidesteps the more basic principle that federal student aid is meant to "prepare students for gainful employment," not to make money for career colleges while saddling students with oodles of debt. Even if students manage to evade default, the federal government has no interest in being complicit in their exploitation. As Stephen Burd of the New America Foundation points out, "The amazing thing to me is that [the CCA's] arguments are, 'We'll have to either lower our prices or cut programs that don't provide students with the training they need to get good jobs." Hardly a convincing argument to anyone not in the business.

A second argument from the CCA, and an argument that has been echoed by Secretary of Education Arne Duncan, blames "a few bad apples." The CCA dismisses a recent Frontline piece highlighting shady recruiting practices by claiming a recent GAO report that found "few" violations of existing laws. The CCA does not mention that by design the GAO report only documents the minority of investigations that ends in fines and does not discuss settlements. Such settlements between for-profit colleges and government investigators have involved millions of dollars, including a $78.5 million settlement by the Apollo Group, the owner of the mammoth University of Phoenix, in December of 2009. It seems that one of those "few bad apples" is the largest career college in America.

Who Is Representing Students?

A coalition of groups including United States Public Interest Research Group, the American Federation of Teachers, and the NAACP has come out in favor of stricter regulation of federal funding for for-profit colleges. Senator Tom Harkin (D-Iowa), chairman of the Health, Education, Labor and Pensions Committee is planning to hold hearings on the matter. One hopes the Senate and the Department of Education will heed those striving to ensure that career colleges provide good value instead of those striving to ensure that career colleges remain exceedingly profitable.

This article was edited on June 16 to clarify the lack of discussion of settlements in the GAO report.

Comments

Virtual Colleges

With all the technology and most colleges going virtual, i think the future of most traditional colleges and universities may not be as bright. Students and consumers of content are becoming more online by every passing day. Regardless of how hard we fight the profit making virtual colleges, we may not easily prevent them from growing. Actually these virtual institutions of learning are becoming popular now in most developing countries as well. So in my opinion, we need to embrace the idea and accept change.

Cannot trust these type of schools

I knew many individuals who attended these schools where they were promised the help of searching for a job. As a result, my friends who attended the school not only went into debt, but couldnt find a job. How can these schools justify that?

As long as there is a public option...

As long as there is a public (affordable) option paid colleges are fine. I wasn't aware of the huge amount of federal/state money poured into this business. This should be limited.

Also, it's everybody's own decision to get into debt for education. I'd even say, it's the best reason take out a loan, definitely better than for a new SUV.